As a Christian, it’s complicated to find the best value healthcare option for your family that also aligns with your beliefs. Not to mention, the healthcare marketplace puts pressure on people to make quick (and expensive) decisions that can have lasting effects on their health, their finances, and even their emotional wellness.

It’s easy to think that traditional health insurance is the only way to guard against unexpected, expensive medical bills. But what if there was another way, that served you better, was more cost-effective, and actually aligned with your Christian beliefs? What if there was a viable healthcare cost alternative?

Healthshare vs Insurance

The first thing to do when looking for healthcare programs is to know what you need to support your lifestyle and family. Here are a few questions to ask yourself and get you in the right direction:

- How many people in your family need healthcare?

- Are there any special needs, such as maintenance prescriptions or pre-existing conditions?

- What amount—and quality—of support do you want?

- What is their provider network? Do they have a restrictive network, or will you have the flexibility to see any provider you need?

- What are you willing to pay out of pocket?

- How does it align with your Christian faith?

Once you know what you’re looking for, you can compare the different healthcare solutions to decide what option is best for you and your family.

Alternatives to health insurance

With the average cost of health insurance skyrocketing each year, it’s a great time to investigate alternatives.

Catastrophic health insurance

One alternative for healthcare is catastrophic health insurance. Because these insurance plans only cover extreme medical bills, they have low monthly premiums and the highest possible yearly deductible. These medical plans don’t help with doctor visits, preventative healthcare, or any other medical situations. They exist only for worst-case scenarios.

Catastrophic health insurance is most widely available to people under 30, since they’re the most likely to not need regular medical care. They’re also available to people who have a government-approved general hardship exemption.

The risk of catastrophic insurance in that it only kicks in when your medical bills get, well, catastrophic. (Hence the name.) In 2024, this means a deductible of $9,450 for an individual or double that for a family per year. Contrast that with the CHM Bronze program, which has an annual Personal Responsibility of $5,000 maximum and, with the addition of CHM Plus, can accrue to share up to $1 million for eligible medical bills.

Health sharing or medical cost sharing

Healthsharing and medical cost sharing, which is another term for health cost sharing, is not insurance. Instead, these organizations bring together people of the same faith and beliefs to help pay for each other’s medical bills. Often, because they’re nonprofit, they’re able to keep the monthly contributions low while empowering members to make better healthcare decisions.

To make sure the organization is credible, look for ways they demonstrate accountability:

- Do they have independent audits?

- Are they accredited by an independent, well-known organization?

- Are you able to see their financials?

- Are they clear on what is eligible or ineligible for sharing?

Healthshare vs insurance

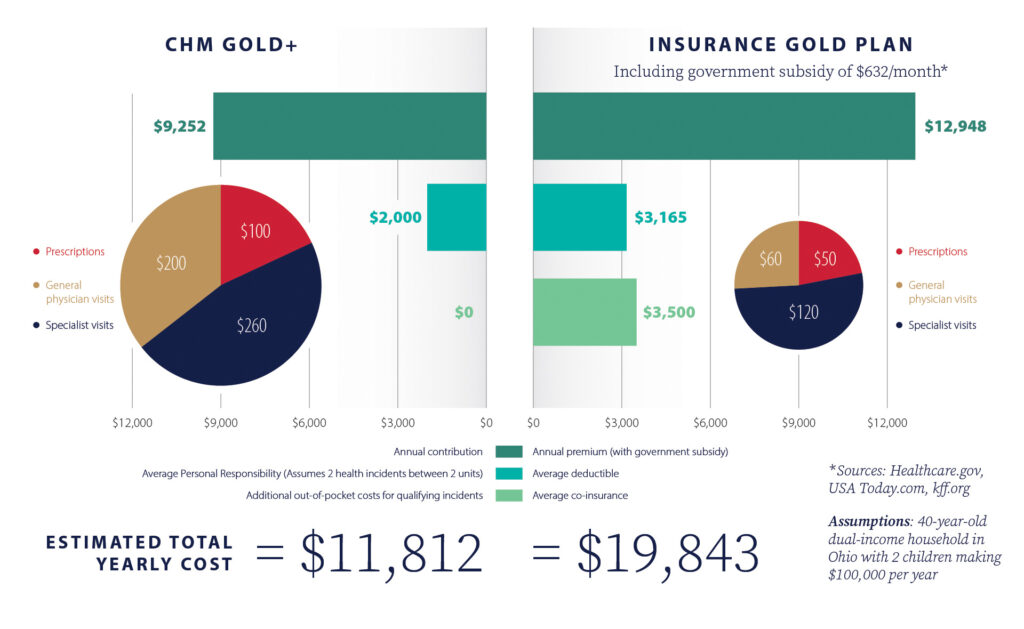

Under the Affordable Care Act (ACA), healthshares are a viable solution to pay for medical bills. But how do they actually match up against insurance?

When comparing a healthshare vs insurance, there’s several major differences. Most notable is the cost difference, the faith aspect, and the provider network.

A healthshare or health cost sharing ministry is a good option for people who:

- want a faith-based option for their medical bills

- want freedom and flexibility to choose the providers who work best for them

- want their financial giving to support other Christian families and ministries

- want a healthcare solution that can support them during any stage of life

More traditional insurance is a good option for people who:

- want a provider network

- don’t want faith involved with their healthcare

- have expensive maintenance prescriptions

- have an active pre-existing condition

Reduce the cost of healthcare

Medical bills are the number one reason for personal bankruptcy in the United States, and these costs keep rising, outpacing regular inflation. That’s why it’s so important that you have a healthcare cost solution that works for your family and prevents the unnecessary burden of paying for medical bills.

Shopping around for different healthcare options is a great way to reduce your healthcare costs. Look for ways that each organization empowers you to keep dollars in your pocket.

- Do they offer virtual care or telemedicine?

- Do they provide ways to reduce out-of-pocket costs for members?

- What solutions do they offer to reduce medical bill costs for their members?

Christian Healthcare Ministries: A healthcare option

for your family

Insurance doesn’t have to be your only option. Christian Healthcare Ministries (CHM) isn’t insurance—we’re the longest-serving biblical solution to taking care of your medical costs.

With over 40 years of experience, our CHM family is ready to support you financially and spiritually during an illness, injury, or other eligible healthcare bills. CHM’s biblical stewardship principles make the most of members’ monthly contributions, and our commitment to transparency makes it so you don’t have to worry about surprise billing, unexpected medical bills, or ineligible expenses. Plus, solutions such as our Maternity Care Solution, Advantage Care Solution, or Virtual Care Solution help lower members’ out-of-pocket costs, making it easier for you to stick to your budget.

Affordable healthcare is possible for you and fellow believers. Our biblical community will enable you to save on healthcare—and gain new healthcare freedom.