Budgeting for a new baby and related family expenses needn’t be difficult.

Whether it’s a simple chart, a detailed spreadsheet, or an interactive, cross-platform budgeting tool, a family budget worksheet is an essential planning guide. Finances are a leading cause of marital stress.

A household budget helps you manage your money, reach your goals and keep baby-budget worries at bay.

Budgeting for baby with confidence in God

When you’re ready to start a family, don’t be discouraged by baby calculators and online reports about the prohibitive costs of raising a child. While savvy stewardship is essential for healthy and happy families, sticker-shock formulas seldom factor in the richness and joys of family life.

When you pray, work and walk in faith, there’s no measure for the generosity of God [2 Corinthians 9:6] and the riches of giving freely [Proverbs 11:24-25]. Smart family budgets factor in things like sound stewardship, hard work, community support, and learning to live within your means.

The bottom line? Every child is a gift from the Lord [Psalm 127:3]. There are added expenses to be sure, but also shared joys, answered prayers, and blessings. Best of all, the greatest riches are measured in hugs, giggles, and assurance that the best is yet to come.

Family budget worksheets and planners

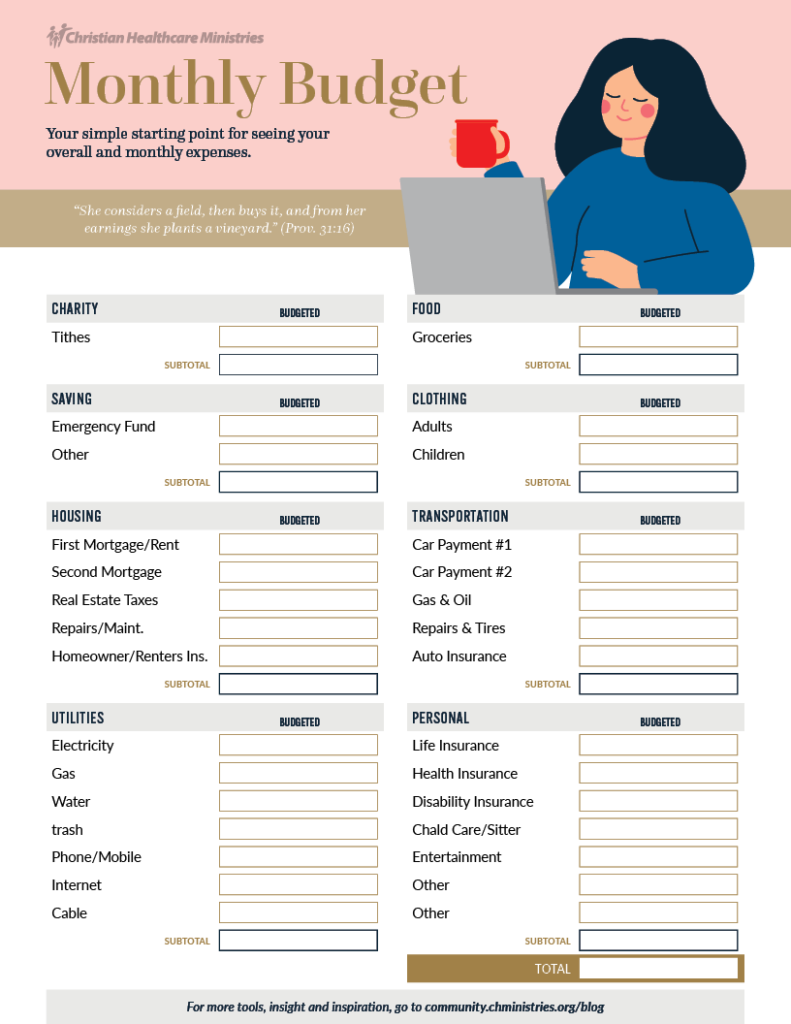

Family budgets, budget worksheets, and planners come in all shapes and sizes. Choose formats that work for you. The most important step is to track expenses, income, and debts, and plan accordingly.

Some people prefer no-frills household budget worksheets with paper and pen. Others use free family budget planners and spreadsheets or other interactive budget tools and apps. Some are free, like the ones you’d find in our Preparing for Baby Kit, while others have convenient add-ons for a nominal fee.

Making monthly family budgets go further

When you’re starting a family, a little planning goes a long way. In addition to tracking family expenses on a household budget sheet, you can take other cost-trimming or income-boosting steps. Review the latest CHM guidelines for cost-sharing and other details as you plan.

Whatever your style, there are ways to make it work. You can:

- Bulk-purchase necessities. These can range from baby food and diapers to wipes, tissues, and laundry detergent.

- Earn more. Ask for a raise and extra hours at work, or find a new job. Consider short-term side hustles such as ride-sharing, pet sitting, or dog walking. Look for close-to-home jobs or work at home as a virtual assistant or freelancer.

- Plan meals carefully. Buy on sale, stock up, and use what’s on hand, including freezer-friendly options. Find like-minded friends to double casserole or cookie recipes, and exchange the extras.

- Share gently used baby basics. Babies quickly out-grow booties, blankets, and teddy bears or comfy tees and jumpers. Curate the cutest hand-me-down clothes and toys, or explore consignment shops.

- Share talents and resources. Maybe you enjoy canning seasonal produce while your neighbor has a garden surplus to share. Whatever your gifts, sharing is a win-win blessing.

“Now faith is confidence in what we hope for and assurance about what we do not see.”– [Hebrews 11:1, NIV]

Creating a family budget

Family budget planning requires clear communication and patience. A well-planned budget is a work in progress. Use our budgeting sheets found in our Preparing for Baby Kit to help you get started on the following:

- List income. Add a line for each, including your after-tax income from paychecks and other income, whether it’s from online auctions, side jobs, or other sources.

- List fixed expenses. Review statements, check logs, and receipts to guide you. Save for emergencies and unexpected expenses. You can refer to someone like Dave Ramsey’s sample family budget percentages to guide you for categories such as:

- Tithes and charity– Reserve funds for your church and other charities or needs as they arise.

- Food – Include grocery and restaurant spending.

- Housing – Include rent or mortgage payments, HOA fees, insurance, and taxes, with subcategories for repairs and other expenses.

- Transportation – Include car payments, insurance, repairs, gas, registration and licenses, and travel.

- Utilities – List electricity, gas, water, and other costs, such as trash pickup.

- Debt payment and savings– Pay debts quickly, and allocate money for savings and retirement.

- List other expenses. Include miscellaneous costs, ranging from childcare, clothing, diapers, and formula, to debts, annual expenses, entertainment, or other nonessential spending.

- Subtract expenses from income. Apply extra money to debts or add it to savings. If it’s a negative balance, adjust line items until you reach zero. You may need to cut nonessential expenses, earn extra income, sell items or downsize your car, home, or gym membership.

- Track your spending. Record every detail, and check with your spouse often. Apps, such as Every Dollar, let you sync your devices so you and your spouse can see where your money is going.

Download our Preparing for Baby Checklist

Sign up to receive our helpful preparing for baby kit! Budgeting sheets, diet and exercise tips, and much more are right at your fingertips.